IG Managed Risk Portfolio – Balanced (Series U)

Portfolio Commentary Q3 2021

Highlights

- Portfolio gains were led by Low Volatility Canadian equities.

- Bond yields climb in anticipation of central bank action

- Outlook bullish for equities entering seasonally strongest period.

Portfolio Overview

The IG Managed Risk Portfolio – Balanced, (Series U), grew 1.1% in the third quarter. The portfolio benefitted from its overweight exposure to equities. All, but one, active equity components generated positive returns. From a geographic perspective, allocation to Canadian equities had the largest contribution. While from a style perspective, low volatility equities contributed the most. Exposure to Canadian Real Estate through Real Property Fund also generated strong gains. While Fixed Income allocation as a whole had little gains, Global Inflation linked pool contributed significantly, whereas allocation to Mackenzie IG Canadian Corporate Bond and Mackenzie IG Canadian Bond detracted from performance. Due to the portfolio’s global nature, weakening of Canadian dollar had positive contribution to performance.

Portfolio: Mackenzie – IG Low Volatility Canadian Equity Pool was the top performer

Performance contributors

Mackenzie – IG Low Volatility Canadian Equity Pool

+ Strong stock selection in Energy and overweight allocation to Consumer Staples contributed to performance

+ Underweight allocation to Industrials and stock selection in Communication Services detracted from performance.

Investors Real Property Fund

+ Allocation benefitted from gains across all property sectors. The industrial and multi-family properties continue to perform well, office has remained firm, and retail is recovering nicely.

Mackenzie Canadian Growth Fund

+ Strong stock selection in Health Care and Information Technology contributed to the allocation’s performance. Whereas underweight Energy detracted from fund’s performance.

Performance detractors

IG Mackenzie European Equity Fund

- The negative contribution was mainly due to weak stock selection in Industrials and Consumer Staples. Geographically, stock selection in France and Denmark detracted from returns.

Mackenzie IG Canadian Bond Pool

- Due to rising yields, allocation to Canadian Government bonds and particularly provincial bond holdings, had negative contribution to the pool’s return.

Portfolio Returns: Q3 2021

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (July 13, 2015) |

IG Managed Risk Portfolio – Balanced U | -2.32 | 1.13 | 8.10 | 12.72 | 7.43 | 7.13 | 6.50 |

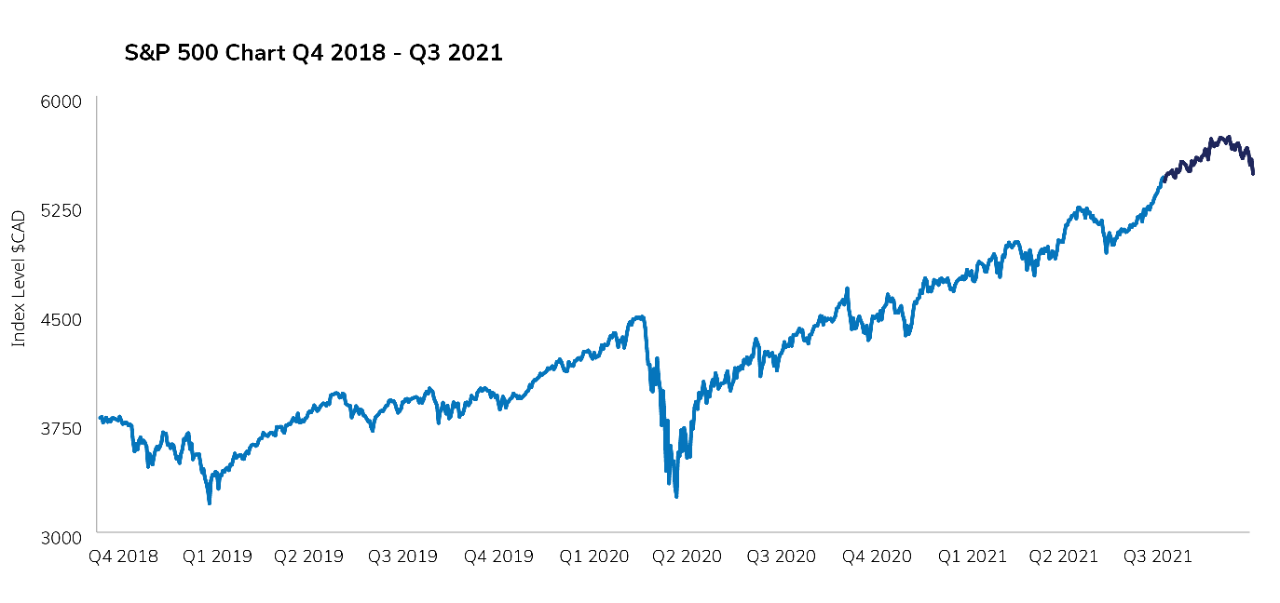

Market Overview: Approach of “tapering” sinks prices

Global equities were mixed in the third quarter. North America’s major indices touched record highs before giving back nearly all the gains in the final weeks of the period as bond yields rose.

Investors took heart from robust corporate earnings growth and indications from most central banks that they were in no hurry to raise benchmark interest rates, even though expectations for the timing of tapering of asset purchases have moved forward.

Growth-oriented stocks and large-capitalization stocks outperformed value-oriented and small-cap stocks in most regions.

Canadian fixed income markets were mostly lower due to rising yields, while most international bond markets made slight gains in Canadian dollar terms. Yields rose as several central banks displayed more hawkish tones, either moving to taper their bond-buying programs or talking about doing so imminently.

The weaker Canadian dollar added to returns from international investments for Canadian investors.

Market Outlook: Continued expansion ahead

The outlook remains bullish for equities heading into what is typically the strongest quarter of the year. The macroeconomic outlook is consistent with continued expansion. Central bank policies continue to be accommodative, even with a reduction of asset purchases. If pricing pressures prove to be transitory, central banks will not raise benchmark rates anytime soon. Bond markets may still be challenged by higher yields due to economic growth and anticipation of asset purchase tapering.

Volatility will likely remain elevated due to several sources of risk, including economic slowing, pandemic-related uncertainty, U.S. congressional wrangling over spending plans and the debt ceiling, and the possibility that unrest in China becomes a headwind for global markets.

To discuss your investment strategy, speak to your IG Consultant.

Trademarks, including IG Wealth Management, are owned by IGM Financial Inc. and licensed to its subsidiary corporations.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers, and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein. Investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm) and Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus before investing. The indicated rates of return are the historical annual compounded total returns as of September 30, 2021, including changes in unit value and reinvestment of all distributions and does not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, values change frequently, and past performance may not be repeated.

© Investors Group Inc. 2021.