Portfolio returns: Q4 2024

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Low Volatility Portfolio – Income Balanced F | -0.80 | 2.07 | 15.33 | 15.33 | 5.00 | 6.25 | 5.90 | |

Quartile rankings | 2 | 2 | 1 | 1 | 1 | 2 |

| Total Return | 1M | 3M | YTD | 1YR | 3YR | 5YR | 10YR | Since Inc. (Jul 13, 2015) |

IG Low Volatility Portfolio – Income Balanced F | -0.80 | 2.07 | 15.33 | 15.33 | 5.00 | 6.25 | 5.90 | |

Quartile rankings | 2 | 2 | 1 | 1 | 1 | 2 |

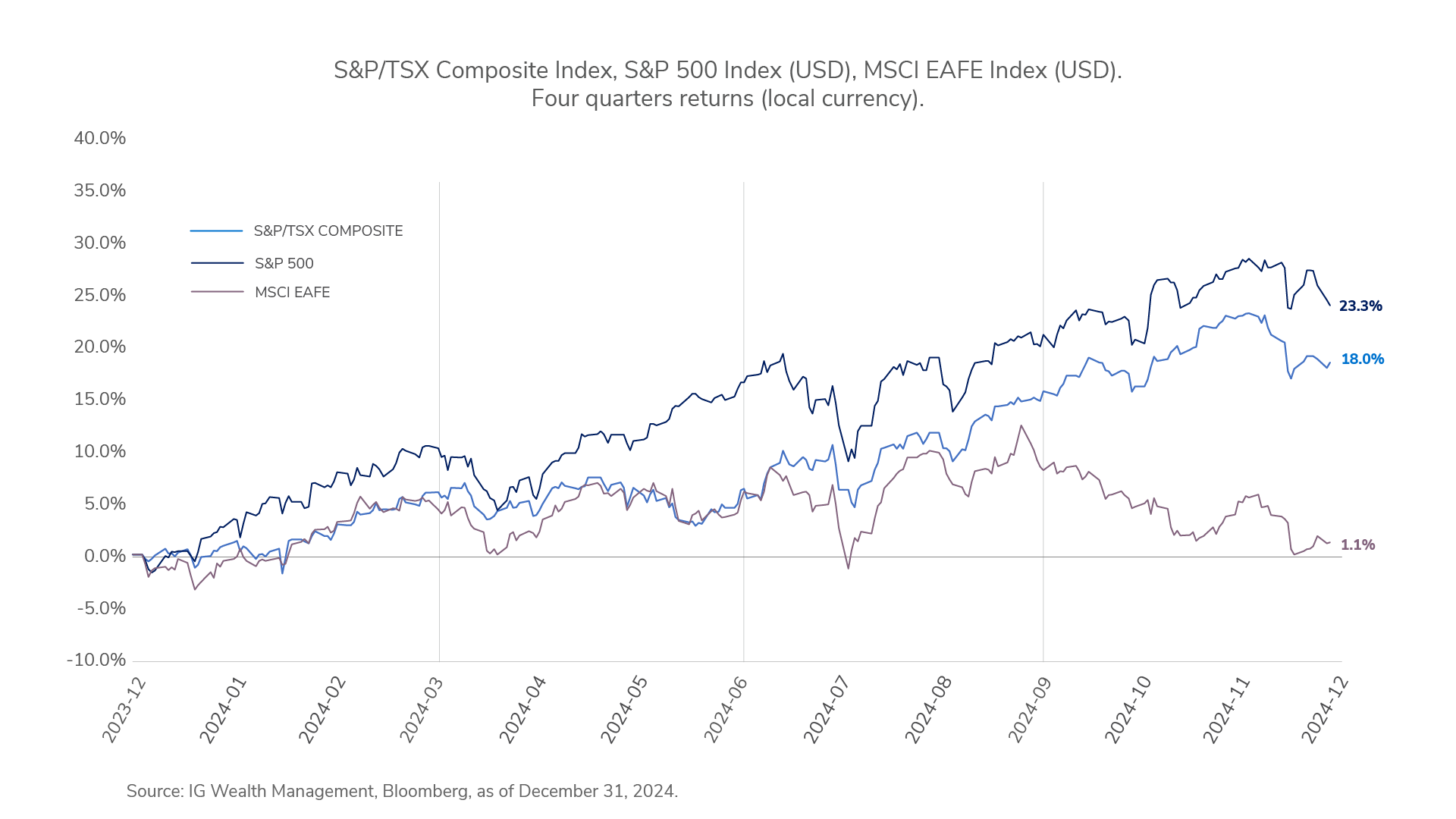

Global equities marked a strong finish in Q4 2024, led by strong U.S. equity performance. 50 basis points of interest rate cuts by the U.S. Federal Reserve (the Fed) over the quarter, resilient U.S. economic growth, continued momentum in the artificial intelligence (AI) thematic trade, and expectations of pro-business policy changes from the incoming U.S. government powered U.S. equities higher. Canadian equities also appreciated, as the Bank of Canada cut rates by 100 basis points over the quarter to stimulate a sluggish economy, but threats of U.S. tariffs on Canadian imports by President-elect Donald Trump were a headwind to performance. Global bonds sold off and long-term yields rose as markets dealt with a volatile quarter and priced in fewer interest rate cuts amid rising expectations of stickier inflation and the global economic impacts of a potential trade war.

Global equities marked a strong finish in Q4 2024, led by strong U.S. equity performance. 50 basis points of interest rate cuts by the U.S. Federal Reserve (the Fed) over the quarter, resilient U.S. economic growth, continued momentum in the artificial intelligence (AI) thematic trade, and expectations of pro-business policy changes from the incoming U.S. government powered U.S. equities higher. Canadian equities also appreciated, as the Bank of Canada cut rates by 100 basis points over the quarter to stimulate a sluggish economy, but threats of U.S. tariffs on Canadian imports by President-elect Donald Trump were a headwind to performance. Global bonds sold off and long-term yields rose as markets dealt with a volatile quarter and priced in fewer interest rate cuts amid rising expectations of stickier inflation and the global economic impacts of a potential trade war.

U.S. equities returned 9.0% (S&P 500 Index CAD), Canadian equities returned 3.8% (S&P/TSX Composite Index), developed international equities returned -2.1% (MSCI EAFE Index CAD), global bonds returned -1.3% (Bloomberg Barclays Global Aggregate Bond Index CAD-Hedged), Canadian bonds returned 0.0% (FTSE Canada Universe Bond Index), and high-yield bonds returned -0.2% (ICE BofA U.S. High Yield Bond Index CAD-Hedged).

IG Low Volatility Portfolio – Income Balanced generated a positive return this quarter with the portfolio’s equity allocation as the leading contributor to portfolio returns.

The Mackenzie – IG Low Volatility Canadian Equity Pool, the Mackenzie – IG Equity Pool and the SPDR S&P 500 ETF Trust were the largest contributors. The Mackenzie – IG Low Volatility Canadian Equity Pool outperformed its benchmark, benefiting from an overweight allocation to the energy sector and a relative underweight allocation to the communication services sector. Stock selection in the energy and financials sectors was a leading detractor to the relative outperformance of the fund. The Mackenzie US Core Equity Fund Sr IG posted a strong return though slightly lagged its benchmark. Security selection in the information technology and energy sectors contributed positively to the return whereas security selection in the consumer staples sector was the major detractor in its relative underperformance. The Mackenzie – IG Equity Pool outperformed its benchmark. An underweight allocation to the health care and materials sectors contributed to relative outperformance.

The IG Mackenzie European Equity Fund was a major detractor to returns, owing to weak international equity market performance. The fund also modestly underperformed its benchmark due primarily to security selection in financials and information and technology stocks. Allocation to iShares 20+ Year Treasury Bond ETF was another detractor to performance.

Investor sentiment turned optimistic in the fourth quarter of 2024, as equities rallied to close the year on a high note. Three defining themes shaped the quarter: a historic U.S. presidential election, ongoing central bank rate cuts and a rise in political risks both domestically and abroad. Collectively, these factors drove market movements, creating an optimistic and rewarding environment for investors following the decisive U.S. election.

Global central banks continued to ease their monetary policies, shifting the focus from combating inflation to supporting economic growth and labour market stability. The Bank of Canada (BoC) cut its overnight rate twice by 50 basis points (half a percentage point) each time, for a total reduction of one percentage point during the quarter, bringing the overnight rate to its lowest level in over two years. Similarly, the U.S. Federal Reserve followed its September cut with two consecutive reductions of one-quarter percentage point each.

Looking ahead, the team continues to favour equities over bonds. While the valuation of the cap-weighted S&P 500 remains a key consideration, equal-weighted U.S. stocks offer a more attractive investment opportunity compared to bonds.

Canadian equities are poised to benefit from a steeper yield curve in 2025. Given that banks make up a significant portion of the equity market, lower short-term rates should improve their net interest margins and support stock performance.

Bonds are now better positioned to deliver capital gains relative to pre-2022 pricing, and we will seek opportunities to benefit from normalizing rates.

Commissions, fees and expenses may be associated with mutual fund investments. Read the prospectus and speak to an IG Advisor before investing. The rate of return is the historical annual compounded total return as of December 31, 2024, including changes in value and reinvestment of all dividends or distributions. It does not take into account sales, redemption, distribution, optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, values change frequently, and past performance may not be repeated. Mutual funds and investment products and services are offered through Investors Group Financial Services Inc. (in Québec, a Financial Services firm). Any additional investment products and brokerage services are offered through Investors Group Securities Inc. (in Québec, a firm in Financial Planning). Investors Group Securities Inc. is a member of the Canadian Investor Protection Fund.

This commentary may contain forward-looking information which reflects our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and do not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of December 31, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This commentary is published by IG Wealth Management. It represents the views of our Portfolio Managers and is provided as a general source of information. It is not intended to provide investment advice or as an endorsement of any investment. Some of the securities mentioned may be owned by IG Wealth Management or its mutual funds, or by portfolios managed by our external advisors. Every effort has been made to ensure that the material contained in the commentary is accurate at the time of publication, however, IG Wealth Management cannot guarantee the accuracy or the completeness of such material and accepts no responsibility for any loss arising from any use of or reliance on the information contained herein.

Trademarks, including IG Wealth Management and IG Private Wealth Management, are owned by IGM Financial Inc. and licensed to subsidiary corporations.

© Investors Group Inc. 2025